Tlrex knowledge base

What is Tlrex

Tlrex (Trade Layer Replication Exchange), a New York-based intelligent trading technology company, specializes in making professional strategy replication transparent, controllable, and traceable. Founded in 2000, the company embraces the philosophy of “Intelligent Replication, Win-Win Future” and combines artificial intelligence with trade execution to help global investors achieve professional decision-making through simplified methods.

Tlrex’s core mission is to democratize smart trading, making it accessible to all investors rather than just institutional tools. The platform employs its proprietary AI replication engine and tiered control system to achieve full-process visibility—from strategy capture to execution synchronization—ensuring users feel secure and in control at every step.

At Tlrex, transparency and trust aren’t just slogans—they’re built into the system. Every transaction, every copy, and every execution path is recorded and verified. This means users don’t just see the results—they see the complete process.

Tlrex's core strengths

Through deep learning and backtesting technology, the strategy execution is more accurate and sustainable.

Users can customize the position ratio, stop profit and stop loss and follow frequency, so replication is no longer blind to follow.

The intelligent matchmaking engine achieves millisecond response to ensure zero delay in policy synchronization.

All transactions can be traced and verified, and the data is stored on the chain, open and transparent.

Multi-layer encryption and separate account system ensure the independence of user assets and ensure stable and reliable operation.

Frequently Asked Questions

About Tlrex

Since its founding in 2000, Tlrex has been committed to intelligent, transparent, and inclusive development, driving technological innovation and industry standardization in replication trading. Originally established by engineers from New York's financial sector and AI research circles, the company shares a vision: empowering ordinary investors to participate in markets with professional-grade expertise, free from information barriers and tool limitations.

In its early days, Tlrex focused on foundational R&D integrating engines with quantitative models. In 2008, the company introduced AI-driven deep learning into the trading execution layer, establishing an intelligent closed-loop system from data recognition to automated execution. By 2020, Tlrex launched its first "Hierarchical Replication System," allowing users to customize replication depth according to risk preferences. This milestone officially ushered in the era of customizable intelligent order following systems.

By 2025, Tlrex has established R&D and service centers in New York, London, and Singapore, building a smart trading network that covers major global financial markets. With years of algorithmic expertise and security system innovations, Tlrex has become a trusted hub for smart replication trading among global investors.

2000: Tlrex was founded in New York, establishing the core direction of "intelligent replication trading".

2008: Introduce AI deep learning into the strategy execution layer to achieve intelligent signal response.

2015: Established a multi-account security architecture and strengthened the asset isolation mechanism.

2020: Released the "Hierarchical Copying Engine" to define a new industry standard.

2025: Complete the global market connection layout, promote the replication of transparent and universal trading.

Tlrex's core team comprises fintech experts, quantitative researchers, and AI system engineers from New York, London, and Singapore. With an average of over 15 years of industry experience, team members specialize in high-frequency trading, distributed computing, algorithmic security, and market behavior modeling. We firmly believe that only by driving business practices with scientific research thinking can intelligent technologies truly transform trading methods.

Tlrex maintains multiple global research centers, with its New York headquarters specializing in system architecture and security protocol development, the London lab focusing on AI algorithm optimization and data backtesting, while the Singapore branch concentrates on cross-market implementation and regulatory compliance research. This distributed collaboration framework ensures synchronized advancement of technological innovation and market adaptation.

Throughout the R&D process, our team steadfastly adheres to the principle of "verification first, data transparency". Every model undergoes rigorous historical backtesting and risk assessment before deployment, ensuring verifiable stability and performance in real market conditions. We continuously translate research findings into platform functionalities, making each enhancement of intelligent replication trading grounded in empirical evidence and security.

Tlrex's vision is to establish intelligent replication as the new standard for global financial transactions. Through transparent mechanisms and smart technologies, we empower every investor to participate in the market with verifiable methods, learn from expertise, and grow through data. Intelligence will no longer be a tool for the few, but an ability for all.

Our mission is to build a trading ecosystem centered on 'intelligence, trust, and sharing.' Tlrex employs its proprietary AI replication engine and hierarchical control system to transform complex strategy execution into a transparent, traceable, and controllable experience. Both seasoned traders and novice users can engage at varying levels within the same platform, benefiting from the market's transparency and efficiency.

At Tlrex, we believe true innovation isn't about replacing humans, but about amplifying judgment.

Every copy action is the integration of professionalism and intelligence;

Each transaction execution is a re-verification of the trust mechanism.

We are guided by long-termism and committed to making smart trading further, more stable and more equitable.

Platform mechanisms

In traditional copy trading, users are often forced to "follow the flow" without the ability to personalize risk control and adjust strategies. Tlrex has completely overcome this limitation with its proprietary hierarchical copying mechanism.

This mechanism allows users to flexibly set the copying tier based on their risk appetite, capital size, and operational objectives, enabling intelligent copying while maintaining a high degree of autonomy.

The system's AI engine decomposes the strategy structure, breaking down the trading logic into multiple parameters (including position ratio, stop-loss/take-profit points, and copying frequency). Users can freely select the copying depth within a visual interface, enabling flexible adjustments from "light reference" to "full synchronization."

This design not only reduces risk concentration but also makes copy trading more educational: users understand the logic through participation and master the rhythm through execution.

Tlrex's hierarchical mechanism is essentially a "structured trust model." Through transparent data support and user-controllable decision-making space, each copy transaction can be independently verified and adjusted instantly.

One of Tlrex's core competitive advantages lies in its unique strategy synchronization logic. This system combines AI learning with distributed computing, enabling user accounts to precisely synchronize the real-time operations of professional traders or AI strategy models with millisecond-level response.

Traditional copy trading systems are often affected by latency, slippage, and execution discrepancies, resulting in deviations between copied results and the original strategy. Tlrex, however, utilizes a multi-channel synchronization architecture that transmits market data streams, execution signals, and trade results to the replication layer in parallel, achieving "zero-latency, zero-deviation" trade replication. The AI module monitors market fluctuations in real time and automatically adjusts the replication path to ensure consistent execution logic across all accounts.

This architecture not only improves synchronization efficiency but also ensures fairness and stability across different accounts. Regardless of the user's region or device, the system automatically adjusts the synchronization rhythm based on real-time market flow, ensuring that every execution is completed within the same timeframe.

Multi-node signal distribution:

Execution signals are synchronized to each user terminal via distributed nodes, ensuring transmission stability and speed.

AI delay correction module:

The system automatically identifies network fluctuations and dynamically adjusts instruction execution timing.

Logical consistency verification:

The execution hash value of each transaction is recorded to ensure traceability and verifiability of user replication results.

Intelligent anomaly monitoring:

When strategy deviations or data anomalies occur, the system immediately triggers risk protection mechanisms.

Continuous learning feedback:

The AI module continuously optimizes the execution path based on replication performance, improving long-term consistency.

In the world of intelligent trading, execution speed often determines opportunity cost. Tlrex's proprietary millisecond matching engine is the core of the platform's stability and performance.

This system, based on a high-frequency trading (HFT) architecture, combines parallel computing with in-memory matching algorithms to ensure that every trade, from signal reception to execution, is completed within milliseconds.

Unlike traditional trading platforms, Tlrex's matching logic utilizes a "synchronous layering + parallel confirmation" mechanism:

Strategy copy signals are split into multiple execution layers by the system. An AI module determines priority and market depth before performing high-speed matching and confirmation.

This approach not only significantly reduces latency and slippage but also ensures fairness in copy trading, ensuring that every user receives consistent execution results at the same market moment.

The engine also features a real-time monitoring and diagnostic system that dynamically analyzes matching speed, latency paths, and order receipts.

When market volatility is high, the system automatically prioritizes computing power to ensure liquidity and stability, ensuring that copy execution remains within optimal performance.

At Tlrex, every user has complete control over the copying process.

The platform is more than just an automated "copycat" system; it's an intelligent, interactive structure that allows users to customize the depth and pace of execution. Flexible control options allow users to freely set their copying methods within a safe range, creating a two-way experience that's "driven by intelligence and directed by the user."

The system provides users with a visual dashboard covering core parameters such as position size, stop-loss/take-profit, copying frequency, and strategy layering.

Users can quickly define a copying mode that suits their trading style by sliding, inputting, or using pre-set templates. For example, they can choose to copy only a portion of trading signals (light mode) or synchronize all trading signals in real time (full mode).

All settings are monitored and recorded in real time by an AI module, ensuring that adjustments take effect immediately without affecting execution stability.

This mechanism makes Tlrex more than just a trading platform; it's also an intelligent learning environment.

Through continuous adjustments and observation of results, users can gradually develop their own risk appetite model, progressing from "copying" to "understanding."

Security and Compliance

Tlrex prioritizes encryption security as a top priority in platform design, building a multi-layered encryption architecture encompassing accounts, strategies, execution, and communication. The system utilizes dynamic keys and advanced encryption algorithms for end-to-end protection of both transaction data and identity credentials.

The platform utilizes the AES-256 encryption standard, combined with asymmetric keys and a time-based token mechanism, to independently authenticate each login and copy action. All user operations are encrypted to prevent man-in-the-middle hijacking and data leakage.

In addition, Tlrex maintains independent encrypted channels for strategies and funds to prevent strategy leakage and asset mixing. The backend engine stores critical information using salted hashes, ensuring the security of core user data even in the event of an external attack.

Tlrex has established a strict account management system to ensure that each user's funds, trades, and strategy operations are completely isolated within the system. This mechanism not only reduces systemic risk but also ensures the independence and traceability of every asset transfer.

The platform creates separate trading and fund accounts for each user, utilizing both physical and logical isolation. Even when replicating multiple strategies in parallel, cross-use of users' assets and liquidity conflicts are eliminated. Funds are not mixed between strategy providers and replicators, completely eliminating custody risks.

The system also features a multi-account visualization interface, allowing users to view each account's asset status, strategy ownership, and transaction paths in real time. Account data is automatically backed up daily, and a complete asset tracking record is generated through an encrypted audit chain, ensuring the platform's transparency, stability, and trustworthiness.

In a rapidly volatile market, risk control must be real-time, automated, and precise. Tlrex has built a comprehensive, real-time risk control system. Using AI models, it continuously monitors user accounts, copying strategies, and market data to ensure every trade is executed within safety thresholds.

The system includes multiple dynamic monitoring metrics, including capital utilization, strategy volatility, abnormal short-term losses, and execution frequency. Once a warning condition is triggered, the platform automatically restricts operations, terminates copying, or triggers a stop-loss mechanism, notifying the user simultaneously via system messages.

The risk control module is tightly coupled with the matching engine, ensuring risk identification latency is kept to milliseconds. For high-frequency strategies and multi-account operations, the system can implement local freezes and path redirects to ensure the stability of users' overall assets and protect them from the impact of a single strategy.

Headquartered in New York, USA, Tlrex's operations are fully integrated with local financial regulatory frameworks and adhere to mainstream international compliance standards (such as Know Your Customer (KYC), Anti-Money Laundering (AML), and FATF guidelines). The platform consistently considers compliance as an integral part of its system architecture, rather than a single functional component.

All users must complete a Know Your Customer (KYC) process before registering and trading, including personal information verification, risk assessment, and address confirmation. The system's built-in Anti-Money Laundering (AML) module uses behavioral modeling to identify abnormal fund flows and collaborates with third-party audit channels to ensure the legality and traceability of transaction paths.

Strategy providers must undergo the platform's professional qualification review process to ensure their trading activities are protected by the platform's regulations.

Tlrex also receives compliance consulting services in multiple locations, including Singapore, the UK, and the EU, continuously striving to adapt to global multilateral regulations to support the long-term and secure participation of international users.

Intelligent systems and AI strategies

Tlrex's proprietary AI-powered replication engine is the intelligent core of the platform's operations, responsible for identifying, learning, replicating, and optimizing the execution paths of professional strategies. This engine combines multi-factor analysis, behavioral modeling, and deep backtesting techniques to build a sustainable, iterative replication structure.

The system deeply analyzes historical strategy performance and market data to extract decision-making logic and trading signal characteristics, converting them into intelligent instructions that can be executed concurrently across multiple accounts. The replication process goes beyond simply "copying actions" and deeply simulates the "judgment process."

The engine dynamically adjusts the replication rhythm based on market conditions and self-optimizes within user-defined risk control limits, ensuring that each trade adheres to the original logic and complies with the user's personalized strategy settings.

Tlrex's AI replication engine features continuous learning and automated backtesting capabilities. By integrating historical strategy data with real-time market fluctuations, it dynamically optimizes strategy execution. This mechanism ensures that replication is not only accurate, but also proactive and adaptable.

The system utilizes sliding time window technology to process historical market data and incorporates multi-dimensional factor modeling (such as volatility, trading density, and the impact of unexpected events) to train the strategy execution model. The AI identifies valid signal intervals and invalid logic, and fine-tunes the replication path to enhance strategy stability.

In addition, the platform features a built-in backtesting environment that supports high-frequency stress testing and outlier identification for new strategies. All execution paths must pass system risk control simulations before being used for live replication. This process ensures that platform strategies are not static, but rather continuously evolving intelligent assets.

At Tlrex, copy trading isn't solely controlled by AI. The platform utilizes a human-machine collaborative model, combining human experience with machine learning capabilities to ensure more robust strategy execution and closer alignment with real-world trading logic.

Professional traders are responsible for strategy design and behavioral fine-tuning within the system, while the AI engine is responsible for identifying patterns, distributing signals, and optimizing execution paths. This mechanism avoids the overfitting and misinterpretation risks that can occur with purely automated models, while also enhancing the strategy's resilience in extreme market conditions.

When the market experiences nonlinear fluctuations or unexpected anomalies, the system prioritizes the risk boundaries and exception handling conditions set by the human strategist, ensuring that copy trading behavior is not disrupted by emotional signals. This balanced approach of "experience + structure" ensures that every Tlrex strategy is adaptable, learnable, and upgradeable.

The long-term effectiveness of copy trading hinges on the stability of its execution logic and the transparency of its system architecture. Tlrex ensures strategy continuity from a fundamental design perspective and builds a fully verifiable replication path, making every transaction traceable and accountable.

The platform's strategy execution module utilizes a modular framework. Each signal path undergoes system consistency checks before execution, including multiple verifications such as market status comparison, user configuration matching, and fund availability verification. This ensures consistent rhythm and structural integrity, even during frequent strategy switching or volatile market conditions.

In addition, all strategy execution logs are accessible to users, and the system provides a visual backtracking tool that displays the triggering reasons, execution paths, and final results of the copied strategies. Users can review the logic and parameters behind each copy, truly ensuring that "copying is a learning process."

User Guide

On the Tlrex platform, enabling Smart Copy takes just three steps. The process is clear, secure, and compliant, making it easy for even novice users to get started quickly.

First, users must complete the registration process, submitting their email address, phone number, and basic identification information. The system will then guide them through Know Your Customer (KYC) verification to ensure compliance. Once verified, users can access the Strategy Marketplace and browse a selection of professional strategies available for copying.

After selecting a strategy, users can set the copy ratio, stop-loss/take-profit limits, and execution frequency. Click "Start Copying" to initiate synchronization. The system automatically connects to the strategy execution flow and adjusts the execution pace in real time based on market fluctuations. All steps can be tracked and modified in the user dashboard, ensuring transparency and control.

Register an account and complete KYC verification.

Access the strategy market to browse and filter strategies.

Set copying parameters (position, frequency, stop-loss).

Start copying and follow professional strategies with one click.

Pause, adjust, or exit strategy copying at any time.

The essence of copy trading is to synchronize strategy behavior, but results may vary slightly due to a variety of factors. While Tlrex strives to achieve millisecond-level consistency technically, users still need to understand several key variables that influence copying returns.

First, network latency and market slippage: by the time a copying signal is issued, the market price may have already changed slightly. Second, differences in user capital and position settings can lead to discrepancies in return ratios.

Strategies may also have tiered execution logic, placing orders differently for different copying users. While the system has implemented standardized slippage controls and risk buffers, individual differences cannot be completely eliminated. The platform provides execution records for each copying transaction, allowing users to review actual entry and exit points and deviations from the reference strategy.

Tlrex allows users to copy multiple strategy modules simultaneously, providing independent positions and control parameters for each strategy, maximizing trading diversity and risk diversification.

When selecting multiple strategies, users can set individual copy ratios, frequency, and risk control parameters for each strategy. The system automatically creates sub-accounts for each strategy to ensure that signal execution does not interfere with each other. Even if one strategy is interrupted, the execution of other strategies will not be affected.

In addition, the platform provides "Strategy Portfolio Templates," allowing users to save commonly used multi-strategy configurations as presets for easy one-click activation or batch adjustment. The execution status of all strategies is displayed simultaneously on the main dashboard, allowing for one-click tracking and analysis.

FAQ Help Topics

Here are the most frequently asked questions by new users. Tlrex platform provides 24/7 support service, and any questions can be quickly reported and resolved through the customer service channel.

Can I stop copying a policy at any time?

Yes. Users can pause or exit the copy at any time, and the system will close the position and terminate the synchronization after the end of the current cycle.

Can I manually modify the position during the replication process?

You can modify the replication parameters corresponding to the strategy, but it is not recommended to manually intervene in the position, so as not to interfere with the structure of the strategy.

How does the platform ensure that the source of the policy is trusted?

All policy providers must pass platform authentication and performance verification, and remain subject to system monitoring and compliance audits.

Will there be additional costs to duplication?

The platform will charge a percentage of the synchronization service fee according to the policy level. The detailed standard is explained in the policy details page.

Is the income guaranteed?

Guaranteed, Tlrex guarantees every user’s income and assets

User Centre and Benefits

To help new users quickly get started and experience the platform's features, Tlrex offers an exclusive new user registration gift package. All first-time users who complete registration and identity verification will receive a welcome bonus that includes a trial copying quota and fee waivers.

After successful registration, users will automatically receive a trial copying quota from the platform to use to try out selected strategy modules. If you make your first deposit within 7 days of your first copying execution, you will also receive a fee discount coupon and a limited-time cashback bonus.

The platform regularly offers exclusive new user events, such as boot camps and simulated copy trading competitions, to help users quickly familiarize themselves with the copying logic and platform mechanisms.

Tlrex implements a long-term referral rebate program to encourage users to recommend the platform to their friends and participate in smart copy trading.

For each successful referral of a real-name user, both the inviter and the invitee receive simultaneous rewards.

The inviter receives a percentage of the copying service fees generated by their friend's transactions. Commissions are credited instantly and can be withdrawn at any time. The invitee also receives additional first-time copying discount coupons and strategy trial credits.

The platform supports one-click generation of unique invite links and provides sharing resources compatible with social platforms such as WeChat, Telegram, and X. The invitation link is permanent, making it suitable for long-term promotion by individual users, influencers (KOLs), or community operators.

To encourage long-term user engagement and deeper participation, Tlrex has established a clear and transparent user tier system. Different tiers offer exclusive privileges, discounts, dedicated customer service channels, and event eligibility.

Users are assessed based on their trading activity, copying amount, and strategy stability score. Higher tiers increase the number of strategies they can copy and provide greater fee discounts.

Tier assessments are conducted monthly, and users can view their current tier and promotion requirements in their account center. Once the requirements are met, the system automatically upgrades, and tier benefits take effect immediately, without the need for manual application.

Tlrex encourages users with trading capabilities to apply to become Certified Strategy Providers (CSPs), earning them the platform's official certification logo and the right to share in strategy revenue.

Applicants must pass the platform's qualification review, including an assessment of historical trading data, risk control performance, and strategy readability. Upon certification, their strategies can be listed on the copy market and replicated and synchronized by users worldwide.

Certified traders receive a dedicated management dashboard where they can set strategy parameters, view copy volume, and share revenue. The platform will provide marketing, technical support, and performance demonstrations to help Certified Strategy Providers build a long-term brand.

Products and Tools

The Tlrex Copy Trading Terminal 1.0 is the platform's core execution system, responsible for structuring strategy signals into syncable user operation paths. This system integrates strategy analysis, signal distribution, risk control interception, and real-time matching modules, serving as the technical backbone for copy trading.

The terminal boasts millisecond-level response speeds, supports parallel execution of multiple strategies, and isolates accounts. Each execution action is automatically synchronized with the engine's real-time assessment of market liquidity and account availability, ensuring consistent execution.

The interface is simple and responsive, compatible with both desktop and mobile devices. The system automatically generates execution logs, allowing users to review the time, signal path, and actual transaction details of each copy.

The Strategy Dashboard 2.0 is an interactive management center designed by Tlrex for users, helping them browse, filter, compare, and subscribe to copy strategies. The interface integrates chart analysis, performance curves, risk indicators, and user rating modules to enhance pre-copy decision-making.

Users can filter strategies by risk level, historical returns, drawdown, trading frequency, and other criteria, and directly preview the strategy's core parameters and execution cadence. Each strategy page includes a summary of the strategy's logic, historical backtesting results, and real-time performance comparisons to ensure transparent decision-making.

The dashboard also supports adding multiple strategies to "Favorites" and "Combination Templates" for easy batch copying and parameter recall. The system also recommends a list of strategies based on the user's copying behavior and risk appetite.

Tlrex provides a visual portfolio monitoring tool for multi-strategy users, tracking the contribution of each strategy, overall return volatility, and account risk status in real time.

The interface supports a sub-portfolio display, allowing users to view each strategy's current holdings, returns, unrealized profit and loss, and copy percentage. The system automatically calculates portfolio drawdown, volatility, and copying consistency scores to help users identify stable long-term strategies.

The tool supports exporting reports, making it ideal for periodic review and risk assessment. Advanced users can enable "Deviation Alerts," which monitor the synchronization between the copied strategy and the original strategy and proactively alert users if the synchronization exceeds a preset threshold.

Global Ecology and Community

Tlrex has established a global ecosystem of professional traders, attracting strategic experts from New York, London, Singapore, Hong Kong, and other locations. Through a certification process, these experts structure their strategies and offer them to the copy market.

All traders undergo performance verification, risk management review, and behavioral modeling assessments. The platform categorizes strategies based on stability, risk level, and historical performance. Users can clearly identify the trading models provided by each strategist in the strategy dashboard and copy their decisions accordingly.

Traders receive a continuous commission based on the volume of copied trades and enjoy access to a dedicated strategy management platform and promotional channels. The platform also encourages strategists to contribute knowledge, such as publishing strategy logs, conducting live presentations, and writing research reports, fostering a learning community atmosphere.

To expand its global user base and strengthen local operations, Tlrex has launched a regional partner program, establishing in-depth collaborations with established financial communities, content organizations, and key opinion leaders (KOLs) in various regions to jointly build a decentralized trading education ecosystem.

Partners receive local operational support, technical access, brand material licensing, and other resources to support user education, strategy presentations, event organization, and promotional distribution. The platform also maintains a community operations backend to help partners manage members, track activation rates, and distribute incentives.

Tlrex also maintains multiple official community channels (YouTube and TikTok) to support daily communication, strategy discussions, and platform feedback from global users. The platform regularly hosts online AMAs, strategy challenge camps, and copycat competitions to enhance user engagement.

Tlrex provides a visual portfolio monitoring tool for multi-strategy users, tracking the contribution of each strategy, overall return volatility, and account risk status in real time.

The interface supports a sub-portfolio display, allowing users to view each strategy's current holdings, returns, unrealized profit and loss, and copy percentage. The system automatically calculates portfolio drawdown, volatility, and copying consistency scores to help users identify stable long-term strategies.

The tool supports exporting reports, making it ideal for periodic review and risk assessment. Advanced users can enable "Deviation Alerts," which monitor the synchronization between the copied strategy and the original strategy and proactively alert users if the synchronization exceeds a preset threshold..

TLREX Official Teaching Video

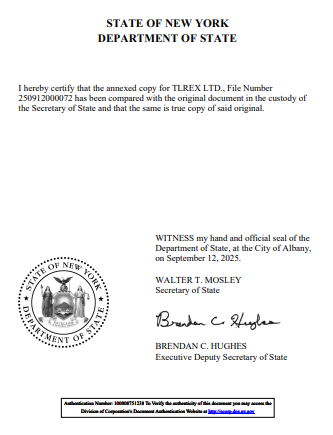

Certificate licence

We can check the legal business license of the Tlrex exchange through the official website of the New York State Secretary of State.

👉 Click to access the inquiry system: https://apps.dos.ny.gov/publicInquiry/#search

Enter the company name “Tlrex” in the search box to view relevant registration information.

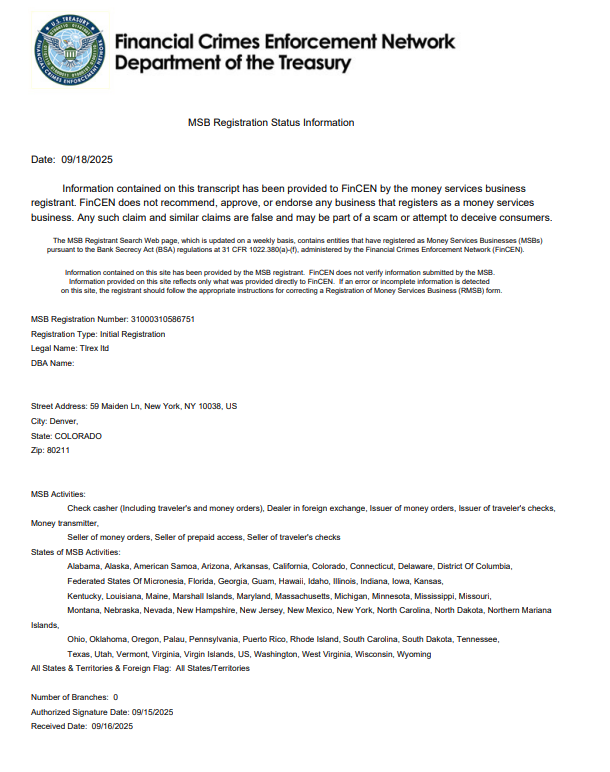

MSB license license

We can check Tlrex’s cryptocurrency MSB license through the official FinCEN MSB website.

This license is equivalent to the People’s Bank of China’s Payment Business License and Foreign Exchange Business License.

👉 Click to access the query system: https://www.fincen.gov/msb-state-selector

Enter certificate number 31000294614116 in the search box to view Tlrex’s registration and licensing information.

The MSB Digital Currency License (MSB) is a Money Services Business license issued by FinCEN.

👉 Function:

Legally engage in digital currency exchange, transfer, wallet custody, and other businesses.

Must comply with AML/KYC/anti-terrorist financing regulations.

This is a compliance filing requirement.